Academy Pro Forex: A Guide to CFD Trading, Brokers, and Market Risks

Academy Pro is an educational platform that bridges the gap between theory and real-world trading. Unlike generic financial courses, this learning platform emphasizes hands-on learning through actual market case studies.

What Is Academy Pro? Learning from Real Trading Cases

- Real Market Analysis: Learn from real trading scenarios, not just textbooks.

- Live Sessions: Gain insights from professional traders in real time.

- Flexible Learning: Study at your own pace, anytime, anywhere.

Every course is designed to turn beginners into confident traders, reinforcing concepts with practical application.

Earning an Academy Pro Certificate

When you complete a trading course that concentrates on one specific financial market, you will be awarded a Market-Specific Certificate, which attests to your proficiency in that particular area.

For those who graduate from the comprehensive All-in-One course, you’ll receive the prestigious PRO Certificate. This credential demonstrates extensive expertise across multiple markets and unlocks new opportunities within the financial sector.

Additionally, both certificates not only enhance your resume but also significantly increase your credibility among peers and potential employers.

Understanding CFD Trading: Types, Advantages, and Pitfalls

CFD (Contract for Difference) is trading contracts for price differences that have revolutionized trading, offering a flexible and accessible way to speculate on financial markets. Unlike traditional stock investing, CFDs allow traders to profit from price movements without owning the underlying asset. You don’t buy the asset itself (for example, stocks, gold or bitcoins), but simply enter into a contract with a broker to change its price. If the price goes in your direction, you make a profit, if it goes against you, you lose money.

Types of CFD trading:

- Short-term – deals for minutes/hours, often with leverage.

- Medium-term – holding positions for several days/weeks.

- Long-term – rare in CFDs, but possible.

Pros of CFDs

✔ Possibility to earn on both growth and fall of the price.

✔ Trading with small capital due to leverage.

✔ Access to different markets (stocks, forex, crypto, raw materials) in one place.

Cons of CFDs

✖ High risks due to leverage – you can lose money quickly.

✖ Commissions, swaps (fee for postponing the transaction to the next day).

✖ No ownership of the asset – you don’t get dividends on shares.

For beginners, education is key to navigating these risks. This is where Academy Pro courses provide a strong foundation.

How to Choose a Reliable Broker

Selecting a trustworthy broker is crucial. A wrong choice can lead to unfair trading conditions, excessive fees, or even fraud. When choosing a broker in CFD trading, first of all, you should pay attention to its license and regulation – reliable brokers are controlled by financial authorities, which reduces the risk of fraud. It is important to study the size of spreads and commissions, as high trading costs can “eat” the profit. Leverage also plays a role: too high leverage increases risks, especially for beginners. No less important is a convenient trading platform – the interface should be clear, and the functionality should meet your needs. You should also familiarize yourself with other traders’ reviews and check the quality of the support service, because in a critical situation, quick help can be a decisive factor.

An informed trader is a protected trader, and education—such as that offered by Academy Pro’s Forex course—helps beginners make smarter choices.

Making Money with Forex: Methods and Opportunities

Forex is a market of currencies, where you can earn on the difference of exchange rates. Theoretically, yes, you can make money, but it is not as easy as it seems. Most beginners lose money because they do not understand the mechanisms of the market and risks.

The main ways of earning money on Forex:

- Speculative trading

This is buying one currency and selling another in order to capitalize on changes in the exchange rate. You can trade manually (analyze charts and news) or with the help of trading bots. The main thing is to be able to predict price movements and control risks.

- Algotrading

The use of trading robots that automatically open and close deals according to a set algorithm. Suitable for those who understand programming or are ready to buy a proven system.

- Copy-trading

Allows you to copy trades of successful traders. You can choose an experienced market participant and automatically repeat the actions, but it is important to realize that his strategy does not guarantee 100% profit.

- PAMM-accounts

This is a method of trust management: you invest money in the account of a professional trader, and this person trades for you. Profits (or losses) are shared proportionally to the investment. The main thing is to choose a reliable manager.

- Arbitrage

This is a search for the difference in currency quotes from different brokers and using this difference to make profit. It is suitable for experienced traders with access to large volumes of liquidity.

- Earnings on affiliate programs

Some brokers pay for attracting new clients. You can earn money if you have an audience (for example, a blog or social media channel).

Is it really possible to make money from Forex?

Yes, as you can see, but it’s not easy money. Successful traders earn money through experience, discipline and competent risk management. Most beginners lose money because of greed, emotions and lack of knowledge. If you want to try, start with a demo account, study risk management and choose a strategy that suits you.

Risks of Trading on the Stock Market

Stock market trading can be lucrative, but it’s far from risk-free. Common risks include:

- Market Crashes: Economic downturns can wipe out investments.

- Liquidity Issues: Some assets are harder to buy or sell at desired prices.

- Psychological Pressure: Emotional trading often leads to poor decisions.

Mitigating these risks requires a solid education, disciplined strategy, and constant learning—principles emphasized in academy pro courses.

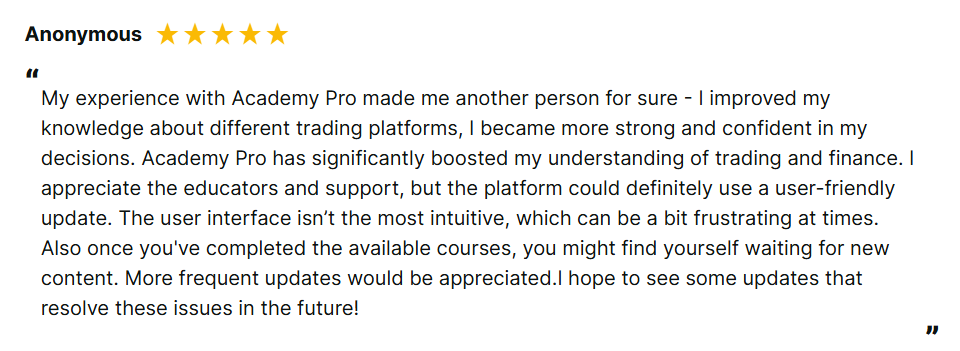

Academy Pro Reviews: What Traders Say

A platform’s credibility is best measured by user feedback.

With overwhelmingly positive academy pro courses reviews, the platform has built a reputation as a trusted resource for aspiring traders.

Final Thoughts

Whether trading CFDs, choosing a broker, or exploring the Forex market, success requires knowledge, discipline, and strategy. For those serious about learning, Academy Pro courses offer a clear path to market mastery.

For beginners, education isn’t an option—it’s a necessity. Markets reward those who are prepared.